Capital Markets – “Dominant Design”

Traditionally markets have been dominated by active participation from institutional funds, retail investors and quantitative systems. The behavior and dynamics of markets are changing at extremely fast pace. New generation retail investors are participating at record pace in trading and investments through mobile trading platforms offered across the globe from Robinhood in USA to Zerodha in India. New phenomenon like WallStreetBets:Reddit are influencing real time investments in traditional trading to new asset classes like Meme stocks , Crypto currencies and NFTs.

Also, markets are now being influenced and reacting in real time more by personalities from business to politics, which is challenging long standing wisdom of markets. The breathtaking pace of markets need new thinking, technology, and traders. Autonomous Trading is the future of investing, using human knowledge to create intelligent machines. Quantitative and systematic investing has been outperformer for several decades , however in recent years they too have faced challenges due to changing market behavior.

Autonomous Car Analogy

Fundamental + Technical Analysis

Artificial Intelligence & Technical Analysis

What are you building, Google Maps vs Waymo?

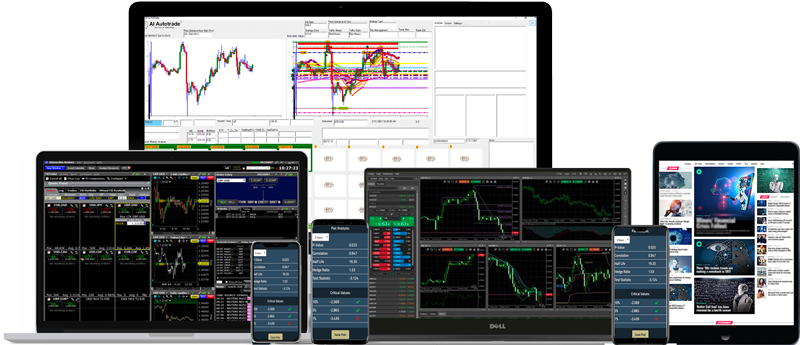

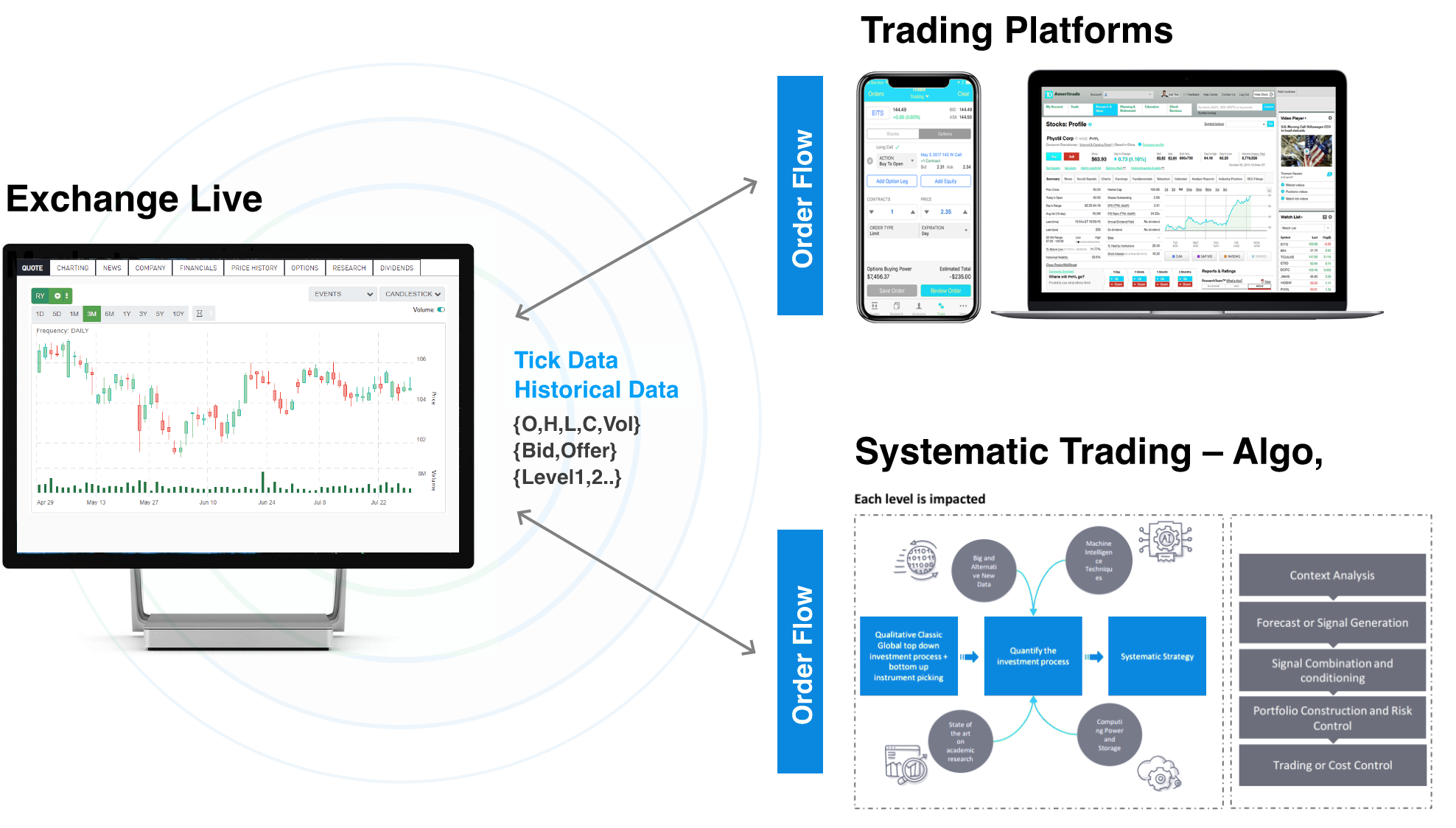

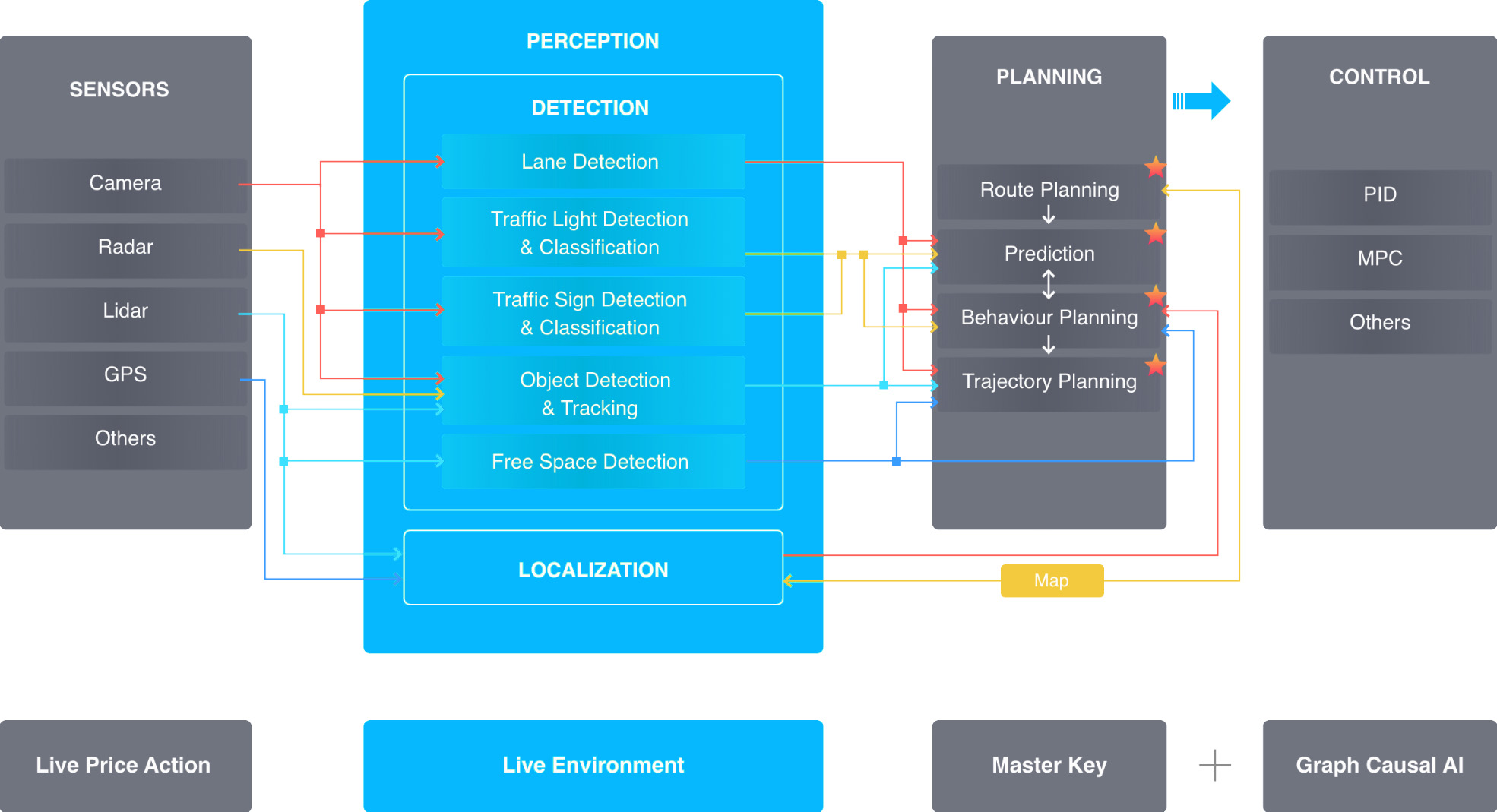

AI Autotrade invested in multi year research and development to solve the market challenges of traditional human and quantitative trading. Autonomous trading must solve same challenges as autonomous driving, both need to make critical decision in real time, combining deep awareness of environment, enormous data flow and complex learning. Autonomous driving has two key components: Maps for direction(eg. Google Maps, Waze) and Driving skill for decision making (Waymo, Tesla FSD). Similarly, in Autonmous Trading we have Fundamental analysis for price direction analysis and Technical analysis for price action decisions.

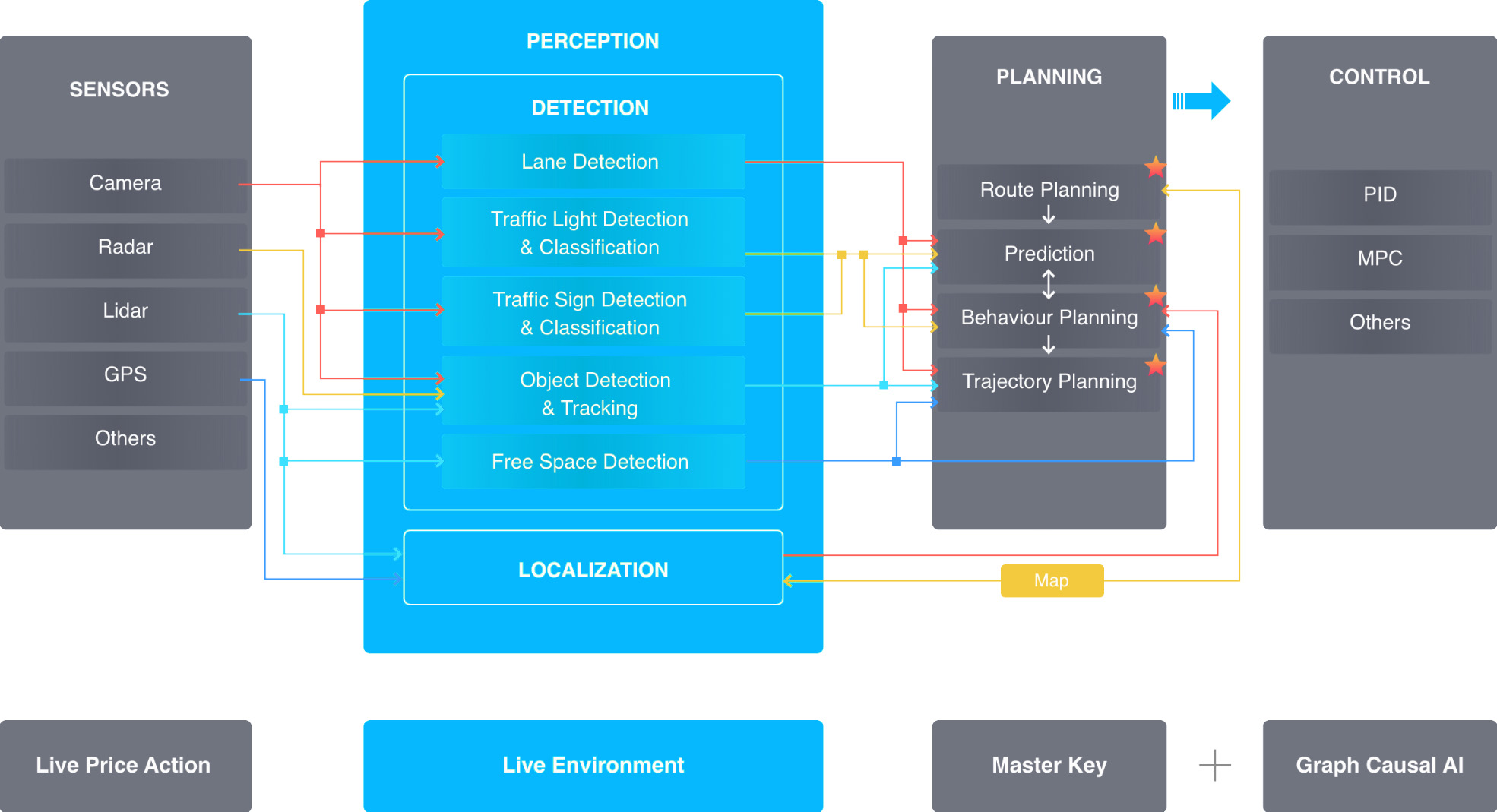

Architecture Reference – Autonomous Cars

Reimagining the First Principles of Autonomous Trading Design

In AI Autotrade we are building Waymo of capital markets, fully autonomous trading machines. It combines deep researched price action technical analysis with next generation deep reasoning AI models using Graphs inspired by Causal AI. The learning models have 4 key components: sensors (live price action), perception (live environment), planning (master key and graph AI) and control (calibration models). New generation of autonomous trading need to be designed to keep up with the fast-paced behavior of markets.

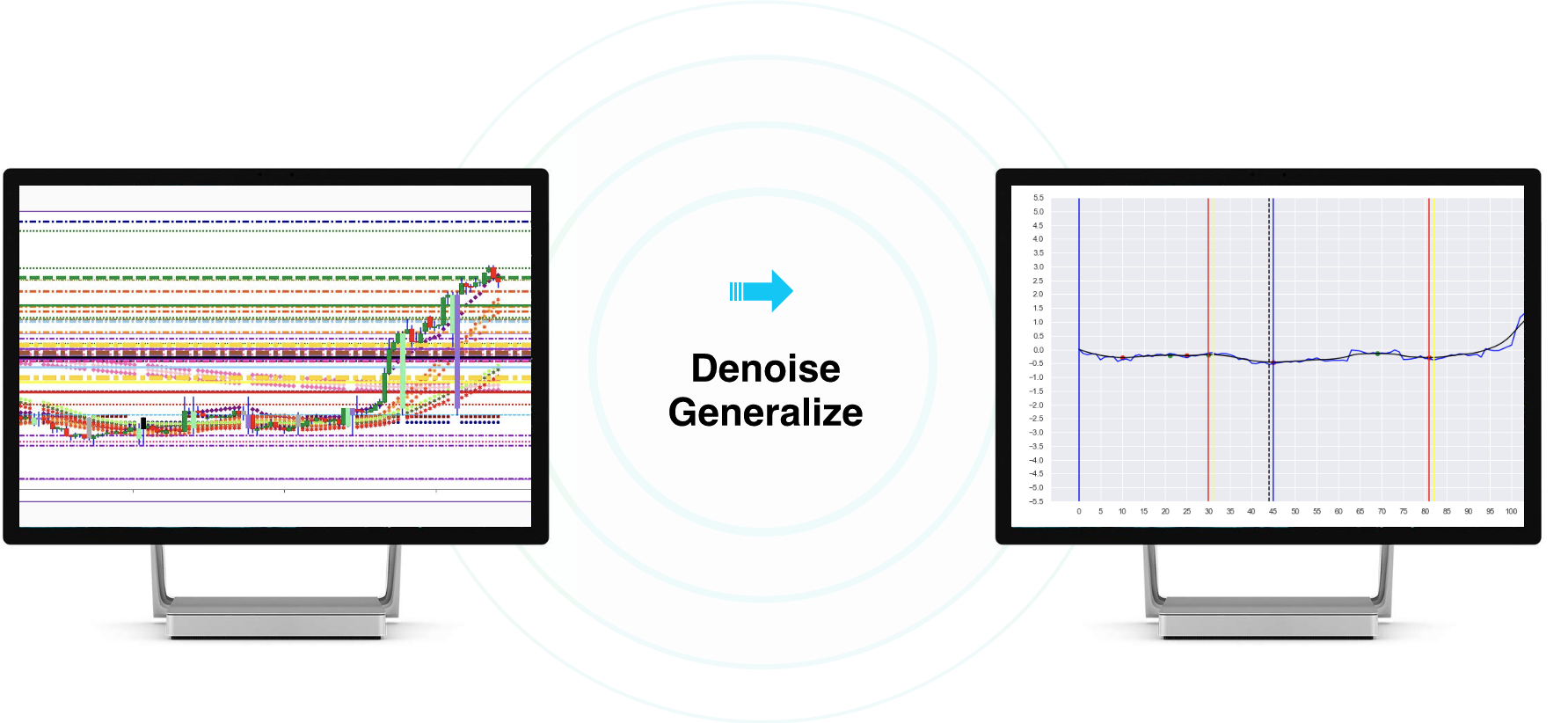

Generalize AI

From Deep Learning to Deep Reasoning

It is very important that any learning is modelled closer to human cognition and reasoning. Humans have unique ability to generalize its environment to optimize learning process. AI Autotrade machines implement next generation models which have capability to generalize its learning through methods of denoise, segmentation, clustering and deep search. It enables the machines to be able trade in multi-market, multi-assets and multi-timeframe opportunities. AI Autotrade machines can trade everything from very volatile Cryptocurrencies like Bitcoin to very liquid Forex pairs like EUR-USD and very stable S&P 500 index.

Market Key – Applications

Markets, Fast and Slow

AI technology has a very high cost of development and maintenance, reliance on big data, complex models and cloud computing. Deployment at scale to trade in hundreds of instruments need to take into consideration Cost of Learning for a financially viable business model. AI Autotrade has developed pioneering autonomous trading machines modelled on Thinking fast and Slow design by Nobel Lauerate Daniel Kahneman, validated by a leading Reinforcement Learning Fast and Slow paper from Deepmind and OpenAI team. AI Autotrade machines use similarity to extract episodic memory from historical market data and apply slow learning on causal AI graph models on a small selective experience.

Machine Level

5. Atom Zero

4. Self Play

3. Master Key

2. Smart Rules

1. Expert Rules

1

Pivot Zones, Moving Averages

2

Expert Machine Hybrid

3

Graph, Neural Network, F-Curves

4

Trade Simulation

5

Autonomous Learning

Level 0

No Autonomy

Human is writing the test and verifying each change to the baseline. AI is doing nothing.

Level 1

Assistance

Human is writing the test and verifying each change to the baseline. AI is assisting in writing test assertions and visually checking the page..

Level 2

Partial Automation

Human is writing the test and verifying each change to the baseline. AI is assisting the change verification by grouping changes..

Level 3

Conditional Automation

Human is writing the test. AI is verifying each change to the baseline.

Level 4

High Automation

Human is assisting in writing the test. AI is writing the test, with human guidance..

Level 5

Full Automation

Human does nothing AI is writing the tests, without human guidance..

Autonomous Trading – Level 5 Autonomy

Our machines have been designed to enable Level 5 autonomy for eyes-off, hands-off trading. Market behavior, trading techniques and technology is evolving at an accelerated pace. AI Autotrade machines are going back to First principles of quantitative trading to build next generation of autonomous machines, with capability to manage dynamic price action, explain it decisions and deploy it at scale with low cost of learning.